Bankrate assists countless customers find mortgage and re-finance lenders every day. We after that designated superlatives based on elements such as costs, products offered, ease as well as other criteria. Over the last few years, fixed-rate home mortgages have been far more typical, as home buyers have actually sought to secure reduced rates of interest. However if you do not plan to remain in the residence long, an ARM might deserve a look.

As a whole, house owners can afford a mortgage that's two to two-and-a-half times their yearly gross income. For example, if you earn $80,000 a year, you can afford a home mortgage from $160,000 to $200,000. Keep in mind that this is a basic standard as well as you require to check out added aspects when figuring out just how much you can manage such as your way of life. ARM is normally a 30-year term car loan with a rates of interest that changes with time with market averages. The very first number marks the very first year your rate of interest will certainly change, and the second number is how regularly the rate of interest resets after the first time.

- Nonetheless, it is necessary to keep in mind that at the end of the set duration at the start of the loan, that rate can change up or down with the market.

- + Rates are based upon an examination of credit report, so your price may differ.

- A home mortgage is a kind of secured loan provided by a banks to cover the cost of buying a residence should you not have enough cash money to spend for it in advance.

- Discount factors that can balance out the cost savings you're getting with a low price.

- Before applying for a finance, make it a point to check Learn more here your credit scores record.

Miss that home window, and also of course, your price could go up https://www.fxstat.com/en/user/profile/cyrinamygy-288167/blog/36466885-Fha-Financings--Prices to match existing mortgage price changes. FHA home mortgage insurance costs are expensive, and add to an already substantial monthly settlement. Not only is this insurance coverage costly, yet securing an FHA lending with a minimum down payment will certainly keep home mortgage insurance on your costs with the loan's complete term. Along with FHA home mortgage prices, the quantity you will certainly pay for the down payment is heavily impacted by your credit score. Customers who are able to add even more in the direction of their FHA car loan down payment normally obtain a reduced rate of interest as a result.

Discover What Home Mortgages You Get Today

We'll discuss its major benefits, and a number of disadvantages to take into consideration prior to taking this choice. We'll also contrast FHA rates versus traditional loan rates, as well as describe why FHA home mortgages might in some cases have reduced or higher rates. Finally, we'll provide a review of different FHA home mortgage programs as well as just how they can deal with particular housing needs.

FHA fundings provide chances for homeownership to buyers by decreasing some of the thresholds to get approved for a home loan. Right here's a consider FHA home mortgage rates today and exactly how this loan alternative can benefit potential buyers. We do not use or have any type of association with loan alteration, foreclosure prevention, payday advance, or short term loan solutions. Neither FHA.com nor its advertisers charge a cost or need anything besides a submission of certifying information for window shopping advertisements. We urge individuals to call their lawyers, credit therapists, lenders, as well as housing therapists. One of the most popular FHA home loan is the fixed-rate lending referred to as the 203.

Exactly How To Purchase Home Loan Prices

" We're not expecting an over night skyrocket", claims Ali Wolf, chief financial expert at Zonda, a California-based real estate data and also consultancy company. Right here is everything you need to understand about scoring the very best rate as well as how much it can conserve you. Try a comparison rate site, or request a recommendation from a pal, relative or a real estate agent. Division of Housing and also Urban Development's Lending institution List Browse device.

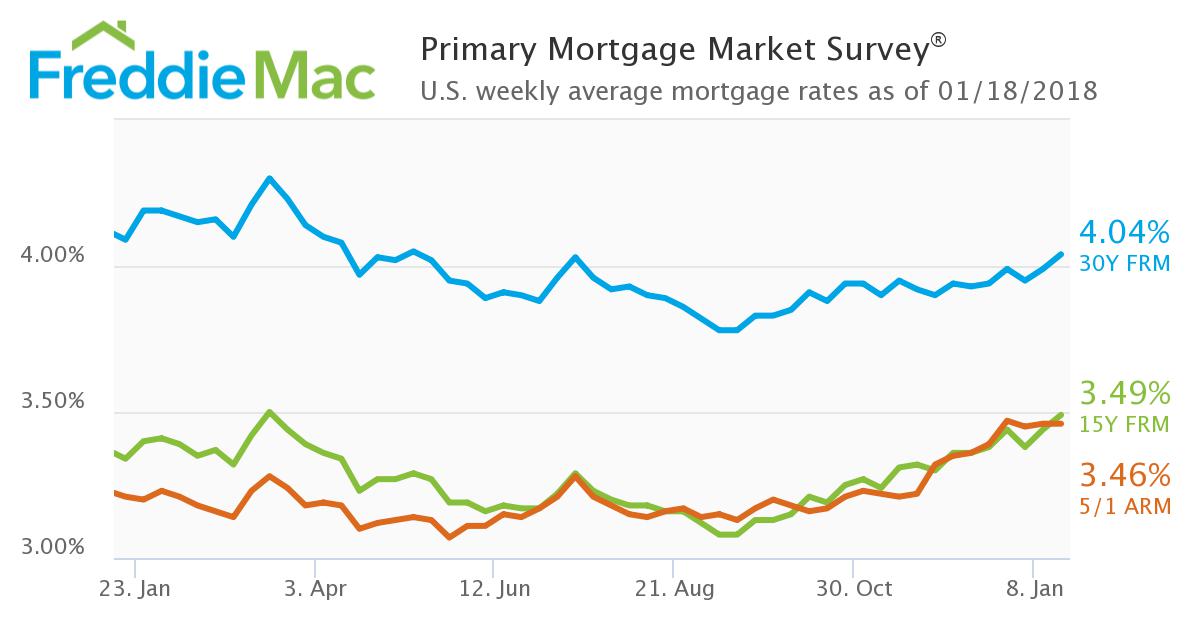

At the time, the typical rate was the lowest considering that Freddie Mac started conducting the study in 1971. The 30-year dealt with average price dropped listed below the 3.69% degree compared to 2019. FHA lendings are commonly made on a 30-year fixed rate amortization strategy, but can additionally be purchased on a 15 year plan.

Fha Financing Restrictions

The FHA looked for to raise housing criteria and enhance liquidity in the housing market. In order to supply you with the best feasible price price quote, we need some additional info. Please call us in order to discuss the specifics of your mortgage needs with among our home mortgage professionals. There isn't simply one rate of interest at any offered time, though. The rate we'll use you might be somewhat higher or lower than the rates you see promoted, because we have to account for all the variables that make your situation distinct. If you're thinking about purchasing or refinancing in 2020, you're in good luck.

The longer you pay on a home loan, the much more you'll pay in interest. The longer term and also greater interest rates of a 30-year financing mean that you'll spend more money on passion contrasted to various other fundings. If you pick a 30-year home loan over one more home mortgage term, your settlements will be reduced.

So if you make $5,000 a month, your home loan repayment and other monthly financial obligation payments can't exceed $2,150. If you desire a collection rates of interest for the life of the loan and more steady regular monthly repayments, then a fixed-rate mortgage is excellent. Your home loan price is the interest you pay on your continuing to be loan equilibrium. It's revealed can you rent a timeshare as a percentage, and also if it's fixed, it will never ever change.